RESPONSIBILITY

TOTAL PRANAMA

SCHOLARSHIP BENEFICIARIE

2024

152

2023

152

Rs. 7 Mn

COST OF

CSR PROJECTS

FAMILY SAVARI REWARD

BENEFICIARIES FOR

2024

1,060

2023

1,245

SALARIES, BONUS &

INCENTIVES

2024

Rs. 3 Bn

2023

Rs. 2 Bn

EMPLOYEE RETENTION RATE

2024 - 64%

2023 - 87%

PROMOTIONS

2024

114

2023

176

FEMALE REPRESENTATION IN

SALES FORCE

2024

54%

2023

54.6%

TRAINING HOURS PER

EMPLOYEE

2024

19.87 hours

2023

18.72 hours

Apps download

2024

12,134

MDRT QUALIFIERS

2024

313

2023

302

TRAINING HOURS PER

SALES

AGENTS

2024

21.20

2023

8.09

TOTAL NUMBER OF

POLICIES INFORCE

961,719

RESPONSIBILITY

TOTAL PRANAMA

SCHOLARSHIP BENEFICIARIE

2024

152

2023

152

Rs. 7 Mn

COST OF

CSR PROJECTS

FAMILY SAVARI REWARD

BENEFICIARIES FOR

2024

1,060

2023

1,245

SALARIES, BONUS &

INCENTIVES

2024

Rs. 3 Bn

2023

Rs. 2 Bn

EMPLOYEE RETENTION RATE

2024 - 64%

2023 - 87%

PROMOTIONS

2024

114

2023

176

FEMALE REPRESENTATION IN

SALES FORCE

2024

54%

2023

54.6%

TRAINING HOURS PER

EMPLOYEE

2024

19.87 hours

2023

18.72 hours

Apps download

2024

12,134

MDRT QUALIFIERS

2024

313

2023

302

TRAINING HOURS PER

SALES

AGENTS

2024

21.20

2023

8.09

TOTAL NUMBER OF

POLICIES INFORCE

961,719

SOCIAL RESPONSIBILITY

Our relationships with key stakeholders remain the foundation of our success, and an integral aspect of our social mandate to operate. Island-wide presence and impact position us to nurture deep, longstanding bonds across society. Founded on the principle of safeguarding Sri Lankans throughout the island, we continuously work to address the health, well-being, and safety of countless Sri Lankans, while continuously anticipating and meeting their needs.

OUR APPROACH TO SOCIAL RESPONSIBILITY

Governance:

Key Challenges:

An evolving socio-economic landscape and high inflation levels have led to a slow-down in policy adoption and increased lapses in existing policies. Low levels of digital and financial literacy continue to impact penetration. The increased levels of migration leads to ‘brain drain’, thereby impacting the availability of skills and capabilities within the sector. Digitalisation has led to cybersecurity breaches and data privacy concerns across business operations.

STRATEGIC INSIGHTS: A SWOT PERSPECTIVE

-

Life insurers contribute to financial inclusion, providing security for underserved populations. Micro-insurance initiatives support low-income groups to adequately manage risks.

An organisation with a reputation for trust and stability.

Investment in CSR activities spanning education, healthcare, disaster relief.

Efficient claims processing and personalised support enhance the policyholder experience.

Well-trained and competent sales agents and employees.

STRENGTHS

-

Dependence on traditional distribution channels (sales agents and physical branches) limiting accessibility.

Improvements needed with respect to employee engagement and workplace satisfaction.

Delay in hiring sales staff due to a lack of applicants.

WEAKNESSES

-

Expansion of micro-insurance to improve financial security among rural populations.

Use of telemedicine and wellness programs to enhance policyholder engagement.

Digital transformation increasing financial literacy and inclusion.

Offering ESG-compliant insurance policies.

Expand recruitment channels and partnering with

universities and other institutions to recruit skilled staff.

OPPORTUNITIES

-

Aging population leading to a shift in insurance product demand.

Privacy concerns with insurers collecting personal and health data.

Potential regulatory changes to enforce social impact reporting.

Inflation and financial downturns that may impact policyholders’ ability to maintain premium payments.

THREATS

">

">

HEAR FROM OUR LEADERSHIP:

R. Renganathan

Executive Chairman

-

A Key development was the use of AI to predict lapsed policies, which served the vital purpose of managing our portfolio and mitigating risks. By utilising advanced predictive analytics, our AI model currently forecasts future lapsation with an accuracy of 80%, marking significantly higher levels than traditional statistical methods. This in turn enables the organisation to operate more proactively with targeted interventions to retain the customer base and also optimises resource allocation within our retention teams.

A cutting-edge AI module was also introduced with the aim of identifying fraudulent claims. By automatically detecting potential tampering or fraudulent activity, the module significantly enhances the speed and accuracy of our fraud detection efforts. This not only protects our financial assets but also safeguards the integrity of the claims process for all policyholders. Reducing the incidence of fraud decreases unnecessary payouts and associated costs, ultimately benefiting our policyholders through more competitive premiums. We will continue to leverage on these technologies to revolutionise how we approach our operations and secure a competitive advantage in the market. -

We are transforming our customer experience by offering a seamless digital experience through omnichannel platforms. The mobile app, available on Android and iOS, allows customers to manage policies, view payment histories, and access services directly from their smartphones. The online customer portal has been upgraded with a user friendly interface, enabling policyholders to access detailed information, initiate claims, and communicate with customer service.

To further enhance efficiency, Electronic Know Your Customer (eKYC) technology has been implemented to streamline the onboarding process. Digital proposal systems, remote signature capabilities, and online payment facilities contribute to environmentally friendly practices, reducing the reliance on paper.

As part of the company's commitment to sustainability, the Walked-in customer e-receipt initiative replaces traditional paper receipts with electronic versions, supporting eco-friendly practices. Furthermore, the Sales Web platform has been introduced to enhance the efficiency of the sales force. This platform streamlines sales processes and supports a paperless approach to sales management, reinforcing Ceylinco Life's dedication to digital transformation and sustainability. -

We implemented a new Document Management System (DMS) to improve efficiency and security in document handling processes. The system includes robust data encryption, secure access controls, and information masking capabilities to protect sensitive customer information. It is fully integrated with other Ceylinco Life systems, ensuring seamless information flow across departments. The DMS also offers centralized storage for efficient retrieval and compliance with local and international data protection regulations. Future enhancements will focus on incorporating artificial intelligence and machine learning technologies to automate document classification and extraction processes.

Safeguarding Policyholders

And Their Needs

03

Platforms for feedback collection

517

Complaints addressed

71.62

Customer Satisfaction Score

37,757

Total service and inquiries

addressed in 2024

4,393

Total survey responses

received in 2024

0.74%

Complaints-to-claims ratio

83.71%

Customer

retention rate

"Perfect Companion for Your Journey Towards Goals"

Scan the QR code

to discover how we help

you reach your dreams.

Social Responsibility

Customer-Centric

Decision-Making

- Prioritising customer feedback and impact in decision-making processes across departments.

- Relying on data analytics and dashboards to streamline decision-making in line with customer dynamics and emerging trends. The Company is currently implementing processes to gather and leverage feedback obtained from CRM systems.

- Capturing customer feedback and ratings across diverse touch-points to determine customer satisfaction levels, identify areas of concern, and take necessary action.

- A documented, IRCSL regulated system facilitates the management of complaints received through various channels including website, social media, branches, and in-person. Customers receive a ticket reference number to track progress, and can contact senior management, and ombudsman, and the IRCSL in relation to any concerns.

Building Community

Awareness

- Promoting inclusivity by focusing on diverse segments in marketing, and offering products tailored to specific demographics such as women and older individuals.

- Focusing on strengthening micro-insurance product offerings to cater to underserved communities.

- A dedicated activation unit is assigned to conduct outreach activities to indirectly promote life insurance and its benefits, while creating strong brand awareness.

- Regular campaigns were conducted in line with significant days of the year to create awareness on the importance of life insurance among the community.

Description of Approach to Informing Customers About Products

The company has provided comprehensive training to its sales officers, covering product knowledge, basic underwriting, and policy conditions. In addition, they have access to a wide range of materials and calculation tools designed to raise awareness and educate customers about the details of the products. After a policy proposal is submitted, a telephone underwriting call is made from the head office to verify the customer’s details and reiterate the policy features and benefits. Upon delivery of the policy, a 21-day cooling-off period is offered. During this time, the contact center initiates an onboarding call to review the policy benefits and payment methods with the customer.

Campaign conducted for Life Insurance Week

Outreach programmes are conducted across schools and communities, covering the topic of exam preparation.

Joint programmes have been commenced with universities to conduct leadership development initiatives, and engage in resource sharing.

17

Year 5 exam preparation

programmes conducted for school children

4,250

Participants in exam

preparation programmes

Communication

and Engagement

- Lapse notices and loan statements are sent as PDFs through SMS thereby ensuring the customer is apprised of policy developments at all times.

- Customer communication has shifted from emails and letters to WhatsApp, with a focus on e-versions of statements and documents. The Company invested in expanding its WhatsApp capabilities and rate of responsiveness through increased staff and capacity expansion.

- Addressing the challenge of customer contactability by updating customer details, and focusing on the long-term development of the app to improve engagement and position it as a central hub of communication.

- Improving communication between the Company, customers, and call centres by strengthening processes.

- Regular meetings with stakeholders take place to ensure action is taken to improve the customer experience.

15

Customer education programmes

13,000

Followers on LinkedIn

12,134

Customer app downloads

3,117

Followers on Instagram

147,000

Visitors to the website

433

Inquiries via Ceylena

176,000

Followers on Facebook

1,441

Followers on TikTok

Social Responsibility

Customer Retention and Loyalty

- Aligning KPIs to reflect renewal of premiums and monthly tracking of clients, thereby encouraging a focus on long-term customer value and customer retention respectively.

- Continuing reward schemes even amid challenging times, to help maintain customer loyalty and value.

- A Policy Conservation Unit project was commenced with the purpose of strengthening existing policy retention, particularly amid employee migration.

- A dedicated Customer Retention Officer (CRO) role and a customer retention unit have been established to follow-up on lapsed policies and offer support to policyholders.

196

Townstorming and megastorming programmes conducted

More than

Rs.54.3 Mn

Disbursed in rewards and benefits

265

Policyholders

1,060

Beneficiaries

Rs. 28 Mn

worth of rewards

152

Recipients

Rs. 22 Mn

worth of scholarships

A cancer fund is maintained for the benefit of policyholders.

This benefit provides financial assistance to policyholders diagnosed with cancer.

Policyholders of Ceylinco Life are eligible for discounts of up to 50% on radiation treatments, through its subsidiary Ceylinco Healthcare Services Limited.

19

Policyholders

Rs. 4.3 Mn

Funds disbursed

Pranama Scholarships

Family Savari

Family Savari

EMERGING

NEEDS

- Exploring new market opportunities, including expanding distribution channels and exploring alternative virtual channels.

- Online capabilities enable interaction with overseas customers, contributing to accessibility and market reach. Leveraging on existing platforms and integrating process adaptations such as remote signature implementation ensured the company could tap into the growing market of locals migrating overseas.

- An increased focus on the youth segment via marketing on social media platforms.

- In order to address customer needs of the period, the Company promoted policies with short term premium payments.

- Shifting towards high-value policies and medical policies to ensure increased returns.

- Product development teams are focused on capitalising on the Company’s strengths to create policies with higher returns, thereby enhancing the customer value proposition.

- In the wake of inflation, data analytics were utilised to run internal campaigns to increase life cover for underinsured individuals through new policies or existing policy increases. Minimum coverage limits for critical illness and major surgery were increased to improve customer satisfaction and address potential instances of underinsurance.

- Utilising RPA to streamline filling of group cover quotation formats by automating the capturing of customer data.

The Customer

Experience

- Identified areas for improvement in the customer app based on usage data, including push notifications.

- Identifying and addressing unclaimed customer benefits, such as claim payments or advanced payments, to ensure customer satisfaction and minimise liabilities.

- Improving processes to expedite policy issuance by streamlining the underwriting process using data analytics and customer risk profiling.

- Hospital certifications are now digitised, simplifying the approval process for insurance claims.

- The Company’s retirement plans offer increased flexibility and customisation compared to competitors.

- Analysing rejected claims in underinsured segments to assess opportunities to offer compensation payments from the Company’s fund.

- Increasing customer convenience by transitioning from traditional in-branch interactions into virtual platforms and home visits. Proof of service is obtained through photographs and video calls.

- Efforts are underway to streamline claim settlement processes, particularly for small claims.

419

Number of unclaimed payment recipients reached through additional efforts

07

Product improvements

and revisions

26

Data analytics dashboards

Social Responsibility

Our Unmatched Commitment to Policyholders.

A Heartfelt Thank You to Ceylinco Life!

"I had lost my policy document and changed my residence, making it difficult to track my policy

details. As a result, I was unaware that my policy had matured. However, Ceylinco Life went the

extra mile to locate me and provided my maturity benefit within just 24 hours after finding me.

Their dedication and outstanding service truly exceeded my expectations. I am extremely grateful for

their support and professionalism.

Thank you, Ceylinco Life, for putting your policyholders first"

Dr. E.S Kularatne

Security

and Good

Governance

- A Data Protection Officer has been appointed, and a data protection management program is underway with external consultants, addressing customer and internal document review, policy and procedure development, and data breach/leakage concerns.

- Stringent measures and protocols are in place to ensure customer confidentiality is maintained. These include number masking for non-essential staff, a three-level approval process for sharing customer data with external parties, and the increasing use of NDAs.

- Customer data transit encryption has been implemented, and a robust process is in place to ensure the safe and secure disposal of customer documents, thereby reflecting the organisation’s protection of sensitive data. Data confidentiality is also maintained during interactions with partners and third parties.

00

Cybersecurity breaches

Rs. 6.7 Mn

Invested in data security enhancements

And Good

Governance

- AML (Anti-Money Laundering) procedures are in place for customer onboarding and servicing, including customer risk profiling, underwriting, and continuous due diligence conducted for high-risk customers.

- A business intelligence team conducts visits to customers at random or as required to assess for fraudulent activities. An honesty index system is used to monitor and penalise sales officers involved in fraudulent or misleading activities. All complaints are monitored and evaluated.

- The Company maintains a zero-tolerance policy towards fraud and does not engage in anti-competitive or anti-trust practices.

- A rigorous approval process is in place for marketing and product-related materials based on IRCSL guidelines, with all disclosures and materials reviewed by the Compliance Officer and relevant regulatory bodies prior to release.

- No legal actions were taken against the Company for anti-competitive behaviour, antitrust and monopoly practices in 2024. No significant instances of non-compliance with laws and regulations during the reporting period.

00

Regulatory sanctions or fines

00

Actions taken against fraudulent behaviour

Policyholders and their Needs

Technology and digitisation provide opportunities for sustainable marketing and operations, while providing opportunities to create a seamless, simplified, customer experience.

- The digitisation of processes across the organisation has ensured optimised performance can be maintained.

Refer to page 170 for more information on digitalisation of organisational processes

Refer to page 159 on the impact of digitalisation on cost savings and resource management

- Conversely, digitalisation creates a space for data breaches and privacy concerns, however, regular updates in cybersecurity and technology ensure the necessary safeguards can be deployed.

Refer to page 208 for more information on the organisation’s approach to cybersecurity and data privacy

- Digitalisation supports improved governance and risk management.

Refer to page 219 for more information on IT governance and its role in risk management

Social Responsibility

Growing Partnerships

With Agents

Strengthening

the Sales Force

Ceylinco Life’s sales force is the cornerstone of the organisation’s success, and contributes to 99% of its total revenue. The sales force comprises diverse individuals from across the island, and has a high representation of female agents, comprising approximately 54% of the total force.

Growing Partnerships with Agents

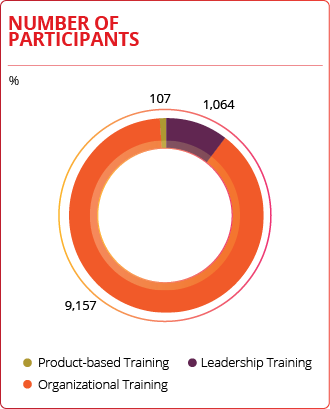

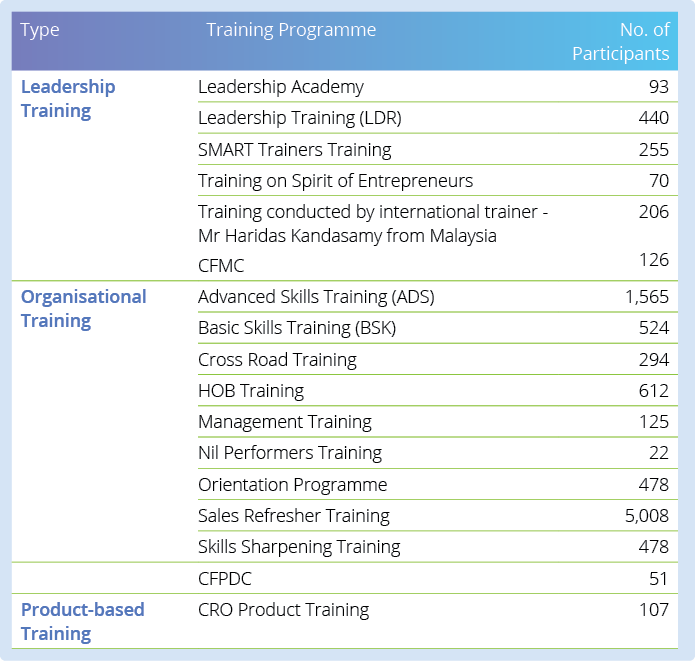

21.20H

Training Hours

Per Sales Agent

10,454

Total Participants for the

Training Programmes

Partnerships with Agents

Digital transformation and the adoption of technology empower service excellence, while simplifying operations, and empowering sales agents to complete their tasks efficiently.

- Providing access to digital resources, and real-time market insights to facilitate performance excellence, remain apprised of new developments, and offer timely solutions to clients.

- The Company relies on Customer Relationship Management Systems (CRM), online policy tracking and digital communication platforms to streamline operations and enhance the customer experience, while enabling the team to work efficiently and effectively.

- The organisation has equipped the sales force with tabs and devices to support sales. Additionally, the organisation’s digital platform is now supported on smart mobile devices, facilitating added convenience at a lower cost.

- Implementing full-time and part-time agents working through virtual channels, with training and connectivity provided through platforms like Teams and Zoom.

- Facilities such as virtual meetings and remote signatures are utilised to support customer convenience and ensure verification.

- Leveraging technology to facilitate lead generation - for example, the referral feature of the Ceylife app enables policyholders to earn income by referring potential customers, thereby creating sales opportunities.

Sales Engagement Programmes

- Daily meetings at branch level with the agency head, supervisors, and the sales force

- Monthly planning meetings

- Branch outings

- Award ceremonies

- Annual general meeting with the union

- Annual sportsmeet

- Virtual Christmas carols

- Digital New Year festival

- Quiz competition

Grievance Management

- The sales force can report grievances to their Agency Head/Agency Supervisors as well as to Regional Sale Managers/Zonal Managers, Business Development Managers and Senior Business Development Managers.

- The Company has launched an Agent Care Call Center, allowing agents to report any issues they may encounter.

- The Company has established a dedicated program called "Liya Saviya" to address and report issues faced by women in the sales force.

- The sales force has the right to directly report their grievances to the Business Development Manager, Board Members, and the Chairman.

GROWING PARTNERSHIPS WITH AGENTS

Rs. 2.48 Bn

Sales force

Commission

313

Agents Qualified

for MDRT Status

2,645

Number of Tabs

provided to Salesforce

- Negative Points: If a sales agent is found to have committed errors or acted in an inappropriate manner, upon proper investigation negative points may be assigned, which will impact the agent’s Key Performance Indicators (KPIs), thereby impacting rewards.

- Fraudulent Activity: The Company has zero tolerance for fraud. Strict actions are taken against sales officers who violate rules and regulations and those who engage in fraud (upon proper investigations).

- Training on Ethics and Good Governance: Agents undergo training in relation to governance/leadership structures applicable to the Company and the insurance industry, in addition to taking written tests on matters related to Anti-Money Laundering, Anti-Corruption and Bribery Policy and any applicable regulations in the insurance industry.

- Code of Ethics and Conduct: Sales agents are trained with respect to the Company’s Code of Ethics and Conduct, and are required to abide by it. Additionally, they comply with the IRCSL Code of Ethics.

- Compliance with Regulations: The Company complies with all regulations pertaining to minimum educational requirements, best practice guidelines, and maximum commission rates stipulated by the relevant regulatory bodies.

- Data Protection: The Company is fully compliant with the Data Protection Act and ensures its principles are practiced throughout the organisation, including within the sales force operations. This commitment ensures that all personal and sensitive data is handled securely and in accordance with legal requirements, protecting the privacy and rights of individuals across all stages of the process.

Nurturing Empowered,

Progressive People

Our workforce plays an integral role in creating and distributing value across our wide-ranging stakeholder groups. Their unique skills, knowledge and capabilities support us in reaching our long-term goals, while their values and deep commitment to sustainability and social responsibility ensures the future of policyholders, communities, and the environment is secured.

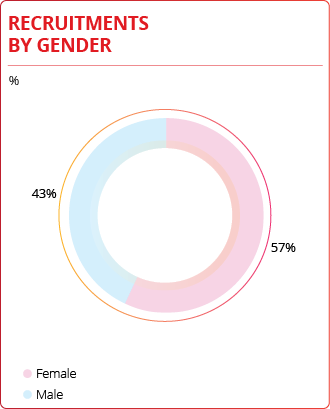

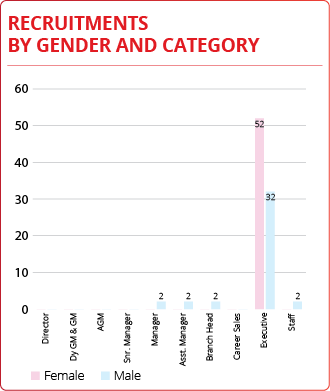

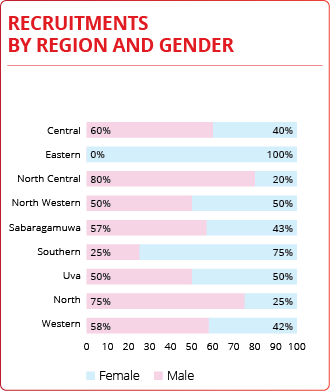

Creating an Inclusive, Diverse Workforce

By actively prioritising female recruitment, Ceylinco Life remained committed to building a balanced workforce throughout the year. The Company also upheld strong policies and mechanisms to foster inclusion and promote diversity.

52

Female Recruits

40

Male Recruits

Social Responsibility

Nurturing Empowered, Progressive People

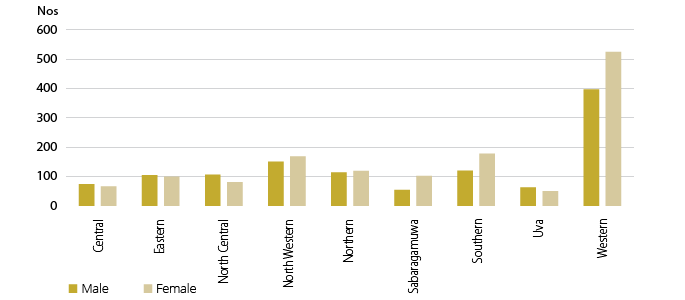

New Recruits by Age & Gender

As an equal opportunity employer, the organisation has implemented a Diversity and Inclusion Policy that encompasses all essential human resource operations and prohibits discrimination based on race, religion, handicap, or any other distinction. The Company’s recruitment policy is strictly merit-based.

Diversity & Dynamics of the Employees

The Company currently employs a total 729 individuals, on full time basis.

Employees by Type & Gender

% of Female Representation - Last 5 Years

1.55%

Growth in female representation

We maintained a consistent female representation (19% to 21%) from 2020 to 2023 and subsequently increased it to 22% in 2024, demonstrating a commitment to advancing gender equality within the organization.

Employees by Category, Age & Gender

Our workforce hails from various age groups and regions across the island. We prioritise recruitment from the neighbouring community, thereby extending value for countless Sri Lankans. All senior management members are recruited from the local community and the Company endeavours to hire from within the region to offer equal opportunities for growth.

Owing to the Western Province serving as the commercial hub of the island, the region is home to approximately half of the employee cadre, while the remaining cadre is nearly evenly distributed among the rest of the provinces. During the year, the Company established multiple contact centres in various regions including the Northern regions, thereby creating greater opportunities for employment. All senior management members are recruited from the local community and the Company endeavours to hire from within the region to offer equal opportunities for growth.

Employee by Category and Gender

Social Responsibility

NURTURING EMPOWERED, PROGRESSIVE PEOPLE

Employees by Region & Category

Nurturing Holistic Health and Well-Being

Being a service-oriented company, Ceylinco Life does not pose a hazardous work environment for its staff.

We believe that the well-being of our employees is fundamental to organisational success. Over the past years, the Company has implemented a range of initiatives aimed at fostering a holistic approach to health and well-being, ensuring that all team

members thrive in both personal and professional aspects. The organisation promotes and advocates for a healthy work-life balance, and leverages on its group synergy with Kings Hospital to provide unparalleled healthcare benefits to its workforce.

Ear Testing

Health Camp

Eye Testing

Medical/Emergency Benefit Schemes Disbursed to Employees

Fire Evacuation Training

First Aid Training

Counselling Sessions and Training

Social Responsibility

NURTURING EMPOWERED, PROGRESSIVE PEOPLE

Health and Safety in 2024

Health and Safety Committee

The health and safety committee is responsible for overseeing of health and safety matters within the organisation.

Objective:

Ceylinco Life values all personnel who enter its premises and takes full responsibility for ensuring their health and safety. We, being a socially responsible entity, treat our environment and surroundings with great respect whilst ensuring that proper controls are in place, aligned with national and international regulations. We commit ourselves towards implementation and continual improvement of set standards on health and safety at regular intervals.

Health and Safety Policy

The Health & Safety policy of the Company is hosted in the intranet for access of all employees.

Currently there is no occupational health and safety management system in place.

Focus Areas:

- A safe working environment

- Safe systems of work

- Provision of necessary information, instructions, training and supervision that is reasonably necessary to ensure that each associate is protected from injuries and health risks

- A commitment to consult and co-operate with associates in all matters relating to health and safety in the workplace

- A commitment to continually improve performance through effective safety management

- Take appropriate, prompt action in response to associates' complaints

Health and Safety Audit

Based on the findings of the health & safety audit conducted in 2024, tangible steps were implemented to ensure compliance with health & safety standards at both the Head Office and branch levels.

Counselling Sessions and Training

An awareness programme was conducted across the head office and branch level on mental health with the support of qualified Counsellor.

Health Camp

A health camp was conducted during the year to promote the physical well-being of employees.

Counselling Programme

For

Ceylinco Life Employees

Conducted by –

Psychological Counsellors

Ms Chathuri Ariyasena

Ms Selani Abeykoon

Contact Numbers –

0778245953 / 0742819557

Sessions – Online or Physical

(Locations – Colombo / Kandy / Matara)

-

• Confidentiality of Sessions:

All counselling sessions will be strictly confidential and solely between the employee and the counsellor. -

• Appointment Booking:

Employees are required to directly contact the provided numbers to book an appointment. -

• Session Options:

You have the flexibility to choose between online sessions or physical sessions. -

• Cost Coverage:

The first two counselling sessions will be fully borne by the company. -

• Employee Eligibility:

This benefit is extended only to Ceylinco Life employees. Sessions for family members can be arranged privately, if necessary.

Please provide your employee number when booking an appointment. This is solely for payment purposes only. The counsellors will not disclose any session-related information to Ceylinco Life.

0

Workplace

Accidents

02

First Aid and Fire Training

Programmes Conducted

62

Participants in First Aid and Fire

Training Programmes

400

Participants in the Mental

Health Awareness Programme

Creating a Conducive Work Environment

We focus on creating a compelling work environment by nurturing opportunities for employee engagement and open communication, in addition to simplifying and streamlining processes to enhance employee productivity. We strive to integrate ethical principles within the organisation, thereby creating a culture of accountability and transparency across all operations.

Employee Engagement and Communication

We encourage employees to express their views and opinions in order to facilitate organisational growth and development. In line with this principle, a new platform called ‘Log your Concern’ was introduced during the year, enabling employees to communicate their concerns with the Human Resources Department for necessary action.

Employee Involvement in Strategy

- A Strategic Planning Committee, comprising five Executive Directors and eight senior employees, meets monthly, while weekly sales meetings are held to discuss strategy and progress.

- An idea generating program is held to encourage staff members to come up with new ideas and fresh concepts. Employees receive feedback on their submissions in order to foster a culture of ongoing learning.

- Any changes to the Company’s rules, processes, or operations are communicated to staff members with sufficient notice and posted on the intranet to ensure their accessibility.

- Internal emails and employee newsletters are alternative channels through which employees can remain informed on significant changes within the organisation. Open Communication, Freedom of Association and Collective Bargaining

- Every permanent employee of Ceylinco Life automatically becomes a member of the Ceylinco Life Employees' Union, which upholds the fundamental right to freedom of association. The Union’s leaders have the authority to bring any issues to the attention of the organisation's highest level, and all members are required to adhere to the Union’s laws and regulations.

- Maintaining cordial, transparent, and ongoing working relationships between the employees and the organisation is accomplished by:

- Quarterly meetings with union representatives

- Adherence to applicable labour laws

- Open-door policies

- A structured grievance handling procedure

- Whistle-blower policy

- Adherence to industrial relations practices

Social Responsibility

NURTURING EMPOWERED, PROGRESSIVE PEOPLE

Integrity, Fair Treatment

and Ethical Practices

Ceylinco Life has implemented extensive policies that outline guidelines pertaining to data protection, whistleblowing, and the prevention of money laundering and terrorist funding, owing to its deep commitment towards preserving integrity and trust.

To ensure zero tolerance against ethical infractions, violations of the organisation’s code of conduct, as well as instances of bribery and corruption, the policies are subject to frequent reviews and amendments as necessary. All policies are hosted in the Company’s intranet and also included in induction programmes.

There were no reported instances of bribery or corruption throughout the year. Additionally, no significant grievances, no incidents of discrimination, violation of human rights or use of child labour, forced or compulsory labour were reported during the year.

Integrating digital capabilities across operations ensures that employees are empowered to utilise automation to minimise mundane tasks and create opportunities for more high-level strategies and ideation. The following improvements enabled employees to achieve greater levels of productivity, and fulfill their tasks seamlessly.

- Transitioning from manual, human-centric processes to a digitalised, automated workflow system.

- Facilitating remote signatures and creating the right platforms to enable the onboarding of Sri Lankan customers living overseas.

- Paperless processes have reduced environmental impact, while improving information accessibility and streamlining tasks.

- Enabled mobility and secure remote management of software by deploying Microsoft 365-powered MDM solutions for all Company-issued laptops, smartphones, and tablets. The organisation supports remote work capabilities for staff with laptops and ensures seamless connectivity between contact centres.

- Strengthening IT governance mechanisms, thereby enhancing data protection and security.

| Policy/Mechanism | Purpose |

|---|---|

| Grievance Handling Policy | Enables employees to alert the management to any grievances and concerns for necessary action. |

| Prevention of Sexual Harassment Policy | A stringent policy is enforced in this regard and communicated across all employee categories. |

| Liya Saviya Hotline | Empowers female employees to report irregularities, grievances and misconduct to an independent committee for immediate action. |

| Whistle-Blower Policy | Robust safeguarding mechanisms ensure that whistle-blowers are protected, while proven violations of ethics, code of conduct and other malpractices are promptly resolved. |

| Prevention of Money Laundering and Terrorist Financing Policy | All employees receive regular training on the policy via the e-learning platform and must read and accept its updates. |

| Anti-Corruption and Bribery Policy | Effectively addresses any irregularities or deviations from established processes and prevents fraudulent activity. |

| Data Protection Policy | A comprehensive organisation-wide policy is in place to prevent data leakages. All information is classified to ensure that only the intended audience has access to it. |

Here from our team: How we foster career growth and development

❝ It has been four years now since I joined Ceylinco Life, a journey which has been so rewarding for me both as an employee and as an individual. During my tenure, I have received so many opportunities from my company for improving not only my knowledge, but also for honing my technical skills. I also had the honour of being recognised with an Outstanding Achievement Award at the company’s Annual Awards 2024. I take so much pride in working for this organisation. ❞

W. P. T. A. Kumara

Technical Foreman

❝ For the past 22 years, Ceylinco Life has been the foundation of my professional growth, shaping me into the person I am today. This esteemed organization has provided me with ample opportunities to develop both technical expertise and essential soft skills, allowing me to thrive in the life insurance industry. Through its unwavering commitment to recognizing and nurturing individual strengths, Ceylinco Life has fostered a culture of trust, loyalty, and career advancement. I am proud to be part of a company that not only empowers its people but also upholds excellence as an industry leader. ❞

Pratheepa Rajakumar

Manager - Operations

Ceylinco Life is committed to recognising its staff members with both intrinsic and extrinsic rewards while fostering their development and progress via ongoing training and development. The Company does not restrict employee mobility, and offers opportunities to pursue prospects for growth and development both inside and outside the Company.

Career Advancement and Succession Planning

Ceylinco Life continued its promotion cycle, and as a result, 114 employees achieved professional advancements during the year. When filling vacancies, the Company prioritises internal recruitment and adheres to clearly defined succession plans. Eligibility for each position is determined by specific requirements and criteria assigned to each employee category.

As a result, Ceylinco Life ensures that every employee is well-prepared for the next phase of their career by bridging skill gaps through targeted training and development programs.

114

Promotions

during the year

18%

of female cadre

promoted

Nurturing Empowered, Progressive People

Promotions by Category & Province

A structured promotion mechanism is adopted by the Company, enabling candidates to demonstrate their eligibility for applied positions, with all promotions made based on cadre requirements.

Training and Development

Training and development is an integral part of Ceylinco Life’s Performance Management System. All employees are required to complete a minimum number of training hours to earn Continuous Professional Development (CPD) points which is linked with their annual and mid-year appraisals.

Employee KPIs reflect their training progress, which in turn influence remuneration, career advancements, and other benefits.

Training needs are collected through a performance appraisal feedback mechanism, while a training needs analysis is conducted periodically.

Ceylinco Life also offered 11 internships to graduates and undergraduates, thereby facilitating the development of future generations and preparing them for the workforce.

Average Training Hours by Type & Gender

Training Hours by Category and Gender

Training on Leadership Developmemt

Rewards, Remuneration and Security

Ceylinco Life maintained its reputation for providing superior compensation while promoting job security and financial stability. In order to increase employee retention and support them in the face of growing living expenses, the Company concentrated on updating its pay and benefits structures. Accordingly, the bonus structure is aligned with the performance ratings of each employee to ensure all employees contribute towards organisational development.

Regardless of gender, all new hires receive a base entry-level salary that is appropriate for their experience and skill level and in accordance with industry standards. The starting salary is far above the government imposed minimum wage.

Remuneration, rewards, and adequacy for promotions are determined based on a comprehensive evaluation process, outlined below:

Awards and Recognition

Social Responsibility

NURTURING EMPOWERED, PROGRESSIVE PEOPLE

Employee Retention and

Talent Management

In Sri Lanka’s labour market, skilled labour migration continues to be a debilitating concern, especially with

respect to white-collar industries. Volatile economic conditions have resulted in many individuals migrating overseas to seek improved prospects. Ceylinco Life also was subject to this phenomenon,

and as a result employee attrition stood at 14%, with 103 resignations taking place during the year.

Employee Retention

Service Period by Category & Gender

As of December 31, 2024, an impressive 64% of the total workforce (470 employees) had been with the Company for more than 10 years. This milestone reflects the organization’s strong culture, career development opportunities, and dedication to employee well-being, reinforcing its position as an employer of choice in the industry.

Turnover by Age & Category

Turnover by Category & Province

PARENTAL LEAVE

With respect to parental leave, Ceylinco Life offers 84 working days for live births. During 2024, out of 9 employees who were due to return to work, 7 employees did so, resulting in a 78% return to work rate. Furthermore, 1 out of 6 employees (17%) who returned during the year 2023 was retained after 12 months.

Return to Work Rate

78% of employees returned to work after parental leave

Retention Rate

(12

- Months Post Return)

Only 17% of employees remained after 12 months

Ceylinco Life Pluralism

At Ceylinco Life, we celebrate diversity and inclusivity as key pillars of our corporate culture. Our commitment to pluralism is reflected in the vibrant traditions, events, and initiatives that bring our employees together, fostering unity and mutual respect.

Throughout the year, we embraced cultural and religious harmony with events such as the Awurudu Celebrations, honouring Sri Lankan heritage, and Bhakthi Gee, which showcased our deep-rooted spiritual values. The Staff Get-together & Christmas Carols created an atmosphere of togetherness, reinforcing the joy of shared experiences.

Ceylinco Life Sports Meet

Social Responsibility

NURTURING EMPOWERED, PROGRESSIVE PEOPLE

We also continued to empower and develop our team through initiatives like the 11th Installation of the Ceylinco Life Toastmasters Club, encouraging leadership and communication skills. Additionally, our Women’s Day celebration highlighted our commitment to gender equality and the invaluable contributions of women in our organization.

Christmas Carols

Christmas Party

These initiatives reflect our unwavering belief that a diverse and inclusive workplace fosters innovation, collaboration, and long-term success. Ceylinco Life remains dedicated to nurturing a culture where everyone feels valued, respected, and empowered to thrive.

Ceylinco Life Toastmasters Club’s outbound meeting - In Malaysia

11th installation of the Ceylinco Life Toastmasters Club.

Group Gathering

Women's Day

Bhakthi Gee

Annual Staff and family Get-together

BUILDING RESILIENT

COMMUNITIES

CEYLINCO LIFE'S COMMUNITY EFFORTS ARE ALIGNED WITH OUR VISION OF PROTECTING EVERY FAMILY, AND SECURING THEIR FUTURE. THESE COMPRISE TWO MAIN FACETS, NAMELY, TO REINFORCE THE NATION'S HEALTHCARE SECTOR, AND SUPPORT THE DEVELOPMENT OF EDUCATIONAL INFRASTRUCTURE. ALL PROJECTS ARE SPEARHEADED, MONITORED AND CONDUCTED BY OUR EMPLOYEES, THEREBY ENSURING THEY ENGAGE WITH THE COMMUNITY AND CONTINUE TO UPHOLD ORGANISATIONAL VALUES IN ALL THEY DO.

211

Total Employees

Involved

3,700

Total Man-Hours

Invested

Educational Infrastructure Development

Identified Problem:

Many schools in remote areas are in dire need of basic infrastructure and facilities.

Response:

Impacted SDGs:

The Company invests in classroom projects, by identifying underprivileged schools, providing them with essential infrastructure such as classrooms and relevant facilities, and engage in their long-term upkeep and development.

Purpose:

Empowering the growth of future generations, while offering them opportunities for strength and stability.

Social Responsibility

BUILDING RESILIENT COMMUNITIES

IMPACT OF COMMUNITY INITIATIVESS IN 2024

Ceylinco Life successfully completed the construction of classroom projects in Galle and Batticaloa districts during the year.

Classroom Project 🔴

Location: GA/Epipiya Bogaha Kanishta Vidyalaya

Rs. 1.7 Mn

Invested

195

Beneficiaries

10

Employees Engaged

Classroom Project 🔴

Location: BT Thalankudah Sri Vinayagar Vidyalayam, Thalankudah, Aryampathy, Batticaloa

Rs. 1.6 Mn

Invested

454

Beneficiaries

12

Employees Engaged

89

Classrooms

Constructed

to Date

Rs. 40 Mn+

Invested

to date

02

Classrooms

Constructed

649

Total

Beneficiaries

Rs. 3.34 Mn

Invested

22

Employees

Involved

📱 Scan the QR

code for a video

perspective of the

new

classrooms.

Supporting the Nation’s

Healthcare

Sector

Maintenance of High

Dependency

Units

Ceylinco Life has constructed and donated fully-furnished High Dependency Units (HDUs) to key government hospitals throughout the island. HDUs are required to upgrade patients from regular care or serve as a step down from critical care, thereby enabling the release of essential space within intensive care units as required. These units are used to treat patients with critical illnesses, or provide post-surgery care prior to transferring the patient to a ward.

A three-person team is solely responsible for monitoring and responding to HDU needs and requests. Additionally, Regional Managers are involved in annually engaging with the hospitals and reporting on any feedback received.

Identified Problem:

The rising costs of healthcare and limited investment on healthcare infrastructure poses a challenge to provide a better care, while placing a burden on rural communities in terms of accessing medical facilities and care.

Response:

Impacted SDGs:

- To conduct health camps to screen people for non communicable diseases (NCDs), to prescribe medicines to control them, and to provide medical advice on the prevention of NCDs by maintaining a healthy lifestyle.

- To build, donate and maintain fully-equipped High Dependency Units (HDUs) and deploy essential medical equipment and support across public sector hospitals.

Purpose:

To support the health and welfare of communities, reduce inequalities, and increase the accessibility of healthcare across the island.

High Dependency Units

Invested in Maintenance in 2024

Patients Served in 2024

Social Responsibility

BUILDING RESILIENT COMMUNITIES

Scan the QR code

for an informative video on the health camps conducted during the year.

Ceylinco Life team involved in organising a Health camp in Neluwa.

Timeline of Investments in Health camps

Compliance and Accountability

The Company did not incur any fines nor non-monetary sanctions for non-compliance with laws and regulations with respect to social and economic aspects in 2024. All investments are monitored, audited and follow due processes to ensure accountability, integrity and ethical practices. All investments in community engagements disclosed herein are in-kind.

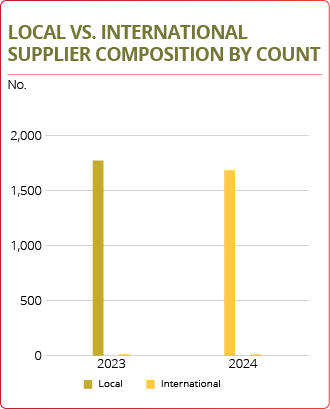

EMPOWERING SUPPLIERS AND

BUSINESS PARTNERS

WE HAVE FOSTERED LONGSTANDING RELATIONSHIPS WITH DIVERSE RANGE OF SUPPLIERS AND BUSINESS PARTNERS. OUR SUPPLIER BASE REPRESENTS A WIDE RANGE OF EXPERTISE THAT HAS HELPED US TO ACHIEVE BETTER QUALITY AND COST SAVINGS.

1,684

Local

Suppliers

11

International Suppliers

713

New Suppliers

Social Responsibility

EMPOWERING SUPPLIERS AND BUSINESS PARTNERS

Transparent, Ethical and Fair Sourcing

Ceylinco Life prioritises transparency and accountability in all its relationships with its suppliers. The organisation strives to maintain long-term partnerships wherever possible, by engaging with a group of carefully selected business partners.

The following processes and mechanisms ensure the organisation upholds equitable and fair sourcing principles:

SCREENING AND QUALITY ASSURANCE

To maintain the highest standards of excellence and quality, we follow a rigorous screening process and a transparent procurement policy. We screen suppliers before engagement to ensure they meet compliance and quality requirements.

To assess supplier competencies and capabilities, we conduct site visits or virtual meetings in addition to reviewing all pertinent certifications and documents. The supplier is added to the supplier database if all criteria are met, and no inconsistencies are evident. All suppliers are required to adhere to the Code of Conduct. During the year, the Company reviewed existing policies and the Code of Conduct to ensure all necessary aspects were covered.

Regulatory Compliance and Ethical Conduct

- Determine supplier compliance with relevant laws and regulations. Strict policies are in place against child labour, and human rights violations.

- Conduct due diligence to ensure adherence to Ceylinco Life’s Anti - Bribery & Corruption Policy.

- Ensure compliance with safety standards.

Sustainable Practices

- Determine compliance with environmental regulations and sustainable sourcing.

- Prioritise partnering with suppliers committed towards environmental sustainability and manufacturing eco-friendly products.

Quality Management and Process Excellence

- Evaluate management, employees, technological and organisational capabilities.

- Evauate whether processes, capacity and technology align with organisational standards.

- Evaluate quality assurance policies and procedures.

- Use of a multi-pronged quality management process, including random checks, customer feedback, and detailed assessments.

Financial Feasibility

- Assessment of cost vs. benefit and ensuring reasonable pricing.

- Evaluation of financial performance and status of suppliers.

- Prioritize on small-scale suppliers to enhance their capacity.

Building Construction

- The Company works with suppliers to maximise resources and implement sustainable methods, such as pre-cast construction and the creation of green buildings.

- Building construction contractors are chosen on a project-by-project basis through a competitive bidding process.

- A specialist consultant evaluates each submitted tender and an advisory body specialising in contractors examines candidates’ qualifications to ensure that regulations set by the Construction Industry Development Authority’s (CIDA) are followed.

- A Director subsequently receives the recommended suppliers’ information for review and approval.

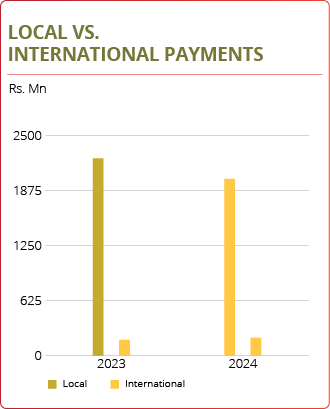

Meeting Supplier Needs

Ceylinco Life does not use credit facilities and consistently aims to pay supplier invoices within days. The organisation holds a strong reputation for trust among suppliers, which leads to long term engagement and high levels of supplier satisfaction. Ceylinco Life also assists suppliers in resolving their working capital requirements.

Should any issues arise, suppliers are provided with the necessary contact details and are even granted the opportunity to approach the highest levels of management with their concerns. The organisation has facilitated suppliers to explore their potential and opened doors to new market opportunities.

During the year 2024, Ceylinco Life organised an awareness programme to employees regarding supplier engagement.

Supplier Development and Training

Where applicable, Ceylinco Life collaborates with suppliers to ensure the optimal project outcomes are achieved. This was particularly evident during the Company’s green building construction process, during which the organisation partnered with its suppliers to uphold principles of responsible resource management and consumption. Contractors were exposed to knowledge sharing and training on sustainable practices as needed, via video tutorials and on-site guidance.

Ceylinco Life – A Guiding Hand in My Journey

Since 2005, we have been working closely with Ceylinco Life as a supplier of gift items.

Struggling as a start-up, the major orders we received from the company eased off our financial burdens and helped us stay afloat. Expanding our business meant investing in better equipment, which led us to look for bank loans. In those moments, Ceylinco Life’s timely payments stood by us like a strong foundation, making it easier to secure f inancial support. Today we work with cutting-edge technology like CNC wood routers and laser cutters, taking our craftsmanship to new heights. But beyond machines and growth, what truly stands out is the guidance, encouragement, and support we received from Ceylinco Life’s officials. Their words and actions pushed us forward.

If there’s one thing I know for sure, it’s that Ceylinco Life played a crucial role in getting us to where we are today. Therefore, from the bottom of my heart, I extend my heartfelt gratitude to the entire Ceylinco Life family. I wish them continued growth, success, and prosperity in the years ahead!

Varuna Athukorala

Athukorala

Enterprises

Partnerships with Reinsurers

Ceylinco Life's relationships with its reinsurers are vital in providing additional assurance against high-value risks and enabling the business to pursue growth and expansion while achieving its goals.

Partnerships with Actuaries

For the past thirty years, Ceylinco Life's internal actuarial team has collaborated with Willis Towers Watson India Private Ltd., a reputable global actuarial consulting firm. While Willis Towers Watson conducts the year-end actuarial valuation, the Company's own employees manage most of the actuarial work. The designated actuary signs off on the valuation results.

Partnerships with Associations

Ceylico Life is a member of the Insurance Association of Sri Lanka (IASL) and represents all of its sub-committees. The IASL is the apex organisation of Sri Lanka’s insurance industry involved in formulating and executing joint industry initiatives. We are also member of the Sri Lanka Insurance Institute (SLII) which is the industry’s sole educational body established to enhance professionalism.

Engagement with Regulatory Bodies

- Financial Intelligence Unit of Central Bank of Sri Lanka.

- Insurance Regulatory Commission of Sri Lanka.

- Department of Inland Revenue

- Sri Lanka Accounting & Auditing Standards Monitoring Board.