THIS IS THE 10TH ANNUAL INTEGRATED REPORT OF CEYLINCO LIFE INSURANCE LIMITED, TITLED

‘BEYOND INSURANCE: A PROMISE FOR LIFE'

Reaching out to our stakeholders through different platforms

Scan the QR code for a quick and easy connect on your smartphone.

The report details Ceylinco Life’s enduring pledge of value, and an impact that extends beyond the sphere of Life insurance, by positively transforming communities across the island

To ensure that this report remains updated and relevant, significant events that occurred beyond this reporting period and up until the Board of Directors' sign-off date on 20th February 2025, have been stated herein. The report of the previous year can be accessed via the Company website on http://www. ceylincolife.com.

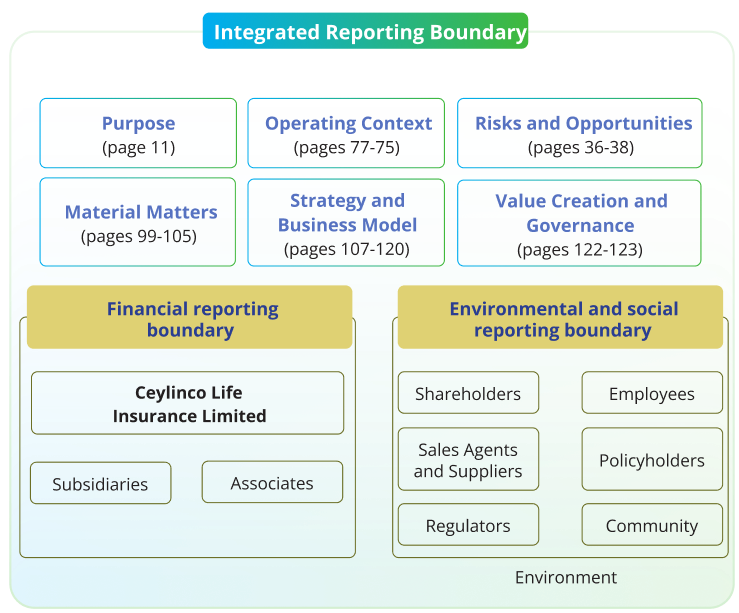

SCOPE AND BOUNDARY

This integrated report provides a comprehensive account of the business activities of Ceylinco Life Insurance Limited during the financial year from 1st January 2024 to 31st December 2024. While financial aspects have discussed from the perspective of the Group, non financial aspect including sustainability reporting have been discussed from the perspective of the Company only.

The integrated Annual Report is consistent with the usual annual reporting cycle for financial and sustainability reporting. Primarily addressed to stakeholders, this report showcases how the Company’s vision articulates and drives the organisation’s strategy, value creation, and stakeholder engagement within the context of an ever-evolving operating environment. In addition to the organisation’s qualitative and quantitative results, this report further outlines the Company’s outlook, and an assurance of its ability to generate long-term value.

SIGNIFICANT CHANGES AND RESTATEMENTS

To reflect Ceylinco Life’s organisation-wide commitment towards sustainability, the Company has disclosed sustainability and climate-related disclosures, aligned with the SLFRS S1 and S2 Standards.

There were no restatements or non-financial changes regarding the Company’s ownership or supply chain during the year. Additionally, no significant restatements were made in non-financial reporting, including sustainability reporting, compared to the previous year.

IMPROVEMENTS TO THE REPORT 2024

| CONTENT |

|

| CONNECTIVITY OF INFORMATION |

|

| GOVERNANCE AND ACCOUNTABILITY |

|

| ACCESSIBILITY |

|

| DIGITAL ENHANCEMENT |

|

INTEGRATED REPORTING

The Company's strategy is based on integrated thinking, which views value creation as a linked, interdependent process that involves the use of six capitals, which comprise the organisation's partnerships, people, and resources. These capitals are deployed with the purpose of fulfilling the Company’s purpose over time, and support the preservation, erosion, and creation of value over time. This strategy is reflected in the report, which demonstrates how the Company's resources, stakeholders, operational environment, risks, and opportunities all play an essential role in creating and carrying out its strategy to realise its ultimate vision.

Adoption of the Guiding Principles of the <IR> Framework

| Strategic focus and future orientation |

Establishing more focused and measurable strategic objectives, KPIs, and targets across

all

pillars. Defining time horizons to measure and manage progress more effectively. Including the financial implications of material matters and CRROs to ensure improved accountability and oversight. The strategy and resource allocation section of the report outlines a comprehensive perspective of business activities over the short, medium and long-term. Risks and opportunities are clearly delineated across the three major time horizons. |

| Connectivity of information | Minimising duplication of information by maintaining connectivity across the report. |

| Stakeholder relationships |

The relationship manager for each stakeholder is identified. The quality of engagement with each key stakeholder is assessed and disclosed. Key stakeholder concerns and our responses are discussed. Key outcomes generated for each stakeholder are disclosed. |

| Materiality |

Reassessing material topics, resulting in the identification of 05 new material

aspects. Reporting material topics in alignment with the strategic pillars. |

| Conciseness |

Utilising page references to minimise the duplication of information. Providing a more high level perspective on the operating context. Relying on graphs and infographics to present information at a glance. |

| Reliability and completeness |

Directors take responsibility for the integrity of the reporting content. Independent assurance is obtained for financial and non-financial information contained in the report. Different reporting frameworks on financial, non-financial and governance reporting are adhered to. |

| Consistency and comparability |

Consistent application of reporting frameworks, business models, and strategic

pillars. Providing comparative information with respect to materiality, sector information, and business performance. |

MATERIALITY

This integrated report is based on matters that are material to the organisation and its stakeholders, thus illustrating a double materiality perspective. During the year, the Company undertook a reassessment of its material topics, resulting in the identification of 05 new topics that pose a notable impact across its operations and key stakeholder groups in the short, medium, and long-term.

Refer to pages 99-105 for more informat ion on the materiality process and topics.

Transparency

Reasonable steps have been taken to ensure that the report contains all pertinent information to facilitate info rmed decision-making. All results, whether positive or nega tive, have been stated accu rately and with full transparency.

- Mandatory and voluntary adoption of reporting practices by the Board (page 7)

- Independent assurance (pages 273-274)

Accountability

Accountability is a key impe rative, as Ceylinco Life serv es as the custodian and mana ger of policyholder risks which have been transferred to the Company.

- Board responsibility for reported content (page 9)

- Accountability for financial reporting (page 263)

Governance

High standards and best prac tices in Corporate Gove rnance are maintained across the organisation.

- A focus on ESG governance, IT governance, supported by robust policies and governance structures.

- Chairman’s perspective and commitment towards governance

- Senior Independent Director’s statement

- Compliance with the Code of Best Practices on Corporate Governance

- Annual Report of the Board of Directors.

- Risk management practices

Sustainability

Sustainability is ingrained within the organisation, ensu ring the needs of the pres ent are balanced with the Comp any’s ability to deliver value for the foreseeable future.

- Assurance on alignment with GRI Standards (pages 266-277)

- Chairman’s perspective on sustainability practices (page 42)

- Sustainability-related policies

FORWARD LOOKING STATEMENTS

This report contains statements on the Company's outlook and future strategy. Ceylinco Life is aware that a variety of risks, uncertainties, and other unknown variables arising from the external environment could cause the actual outcomes to diverge significantly from the goals and expectations outlined in this report.

The Company does not undertake responsibility for publicly updating or disclosing any changes or adjustments to any forwardlooking statements owing to potential discrepancies in circumstances or events that may arise after the reporting date.

| Reporting Framework | Guiding Principles | Internal Assurance | External Assurance |

|---|---|---|---|

| Financial, Governance & Risk Management | Sri Lanka Accounting Standards (SLFRS/LKAS) issued by CA Sri Lanka | Reporting to Board Audit Committee | Independent Auditor’s Report (refer to pages 273–274) |

| Regulation of Insurance Industry Act No 43 of 2000 | Internal Audit Internal control mechanisms |

Appointed Actuary’s Report (refer to page 272) |

|

| The Companies Act No. 7 of 2007 | |||

| IRCSL Direction No. 2 of 2022 – Corporate Governance Framework for Insurers | |||

| Code of Best Practice on Corporate Governance issued by CA Sri Lanka | |||

| Integrated Reporting | International Integrated Reporting Council’s (IIRC) Integrated Reporting <IR> Framework | Self-certification based on the IIRC framework | Independent Auditor’s Report on Integrated

Reporting (refer to pages 268–269) |

| A Preparer’s Guide to Integrated Corporate Reporting issued by CA Sri Lanka | |||

| Handbook on Integrated Corporate Reporting issued by CA Sri Lanka | |||

| Sustainability Reporting | Global Reporting Initiative (GRI) Standards 2021 – Core option | Self-certification based on the GRI Standards | Independent Auditor’s Report on Sustainability

Reporting (refer to pages 266–267) |

| United Nations Sustainable Development Goals | |||

| Non Financial Reporting Guideline of CA Sri Lanka | Carbon Footprint Assessment | ||

| SASB Standards – Insurance | |||

| SLFRS S1 and S2 Standards (voluntary adoption) |

PRECAUTIONARY PRINCIPLE

The organisation follows the precautionary principle with respect to social and environmental sustainability, and has taken tangible action to reduce any negative impact to the environment and surrounding communities.

The Company has also focused on climate change mitigation as a key focus area, while integrating Climate Risk and Related Opportunities (CRROs) into its risk management processes to drive increased environmental responsibility into its processes.

FEEDBACK AND CONCERNS

We remain deeply committed towards improving the readability, relevance and content presented within this report year-on-year.

Please direct your feedback to:

Company Secretary,

Ceylinco Life Insurance Limited,

No. 106, Havelock Road,

Colombo 5, Sri Lanka

Telephone: +94 11 246 1327

E mail: kushanw@ceylife.lk

Web: www.ceylincolife.com

NAVIGATING THIS REPORT

CAPITALS

Financial Capital

Manufactured Capital

Human Capital

Intellectual Capital

Social and Relationship Capital

Natural Capital

STRATEGIC PILLARS

Financial Performance

Social Responsibility

Corporate Governance

Environmental Sustainability

Stakeholders

SHAREHOLDERS

POLICYHOLDERS

REINSURERS

ACTUARIES

EMPLOYEES

SALES AGENTS

INDUSTRY ASSOCIATIONS

COMMUNITY AND ENVIRONMENT

SUPPLIERS

UN SDGs

BOARD RESPONSIBILITY STATEMENT

Dear Stakeholder,

This integrated report outlines the strategies adopted during the year to successfully navigate the operating environment and their resulting qualitative and quantitative outcomes. While providing insights into our outlook and future perspective, this report presents a balanced view of our performance and all matters material to our stakeholders have been adequately disclosed.

All contents herein were prepared under the guidance and direction of the Corporate and Strategic Management teams and have been reviewed by both internal staff members and external consultants. The Board is confident that this report is compliant with applicable reporting frameworks, as outlined on page 7. The Board acknowledges that it holds the full and final responsibility for ensuring the integrity of the report and its contents. All information has been assessed by the Board for its accuracy, validity and its impact on decision-making.

This report was approved by the Board of Directors on 20th February 2025.

Signed for and on behalf of the Board by;

R Renganathan

Executive Chairman

E T L Ranasinghe

Managing Director/Chief Executive Officer

20th February 2025