Ceylinco Life assesses industry dynamics and a wide range of socio-economic factors in order to develop a relevant and robust strategy that caters to present and emerging needs. Additionally, the organisation considers the economic outlook in order to derive a future of long-term success and stability.

operating environment

To analyze the operating environment we use the PESTEL framework, which looks at the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company. This analysis can give us a clear picture of the external forces shaping Ceylinco's operations and strategy.

Industry Analysis

PORTER’S FIVE FORCES ANALYSIS

-

- A minimum capital requirement of Rs. 500 Mn

- Heavily regulated by the Insurance Regulatory Commission of Sri Lanka (IRCSL), which imposes capital requirements (Minimum CAR 120%) and solvency regulations, making entry difficult.

- Need to maintain high levels of brand trust and credibility

- Potential disruption from Insurtech startups

- Need for expert resources such as actuaries, reinsurers, chartered insurers etc.

- Licensing requirements from regulators

-

- High dependence on reinsurers (e.g., Swiss Re, Munich Re)

- Actuaries, underwriters, and investment professionals are crucial, and a shortage of skilled professionals can increase supplier power.

- Insurers increasingly rely on third-party tech firms for digital transformation, making them dependent on specific vendors for AI, analytics, and cloud-based solutions.

-

- High switching costs (e.g. surrender penalties, low initial fund values, single premium option etc.)

- Customers often engage in policy comparison and demand improved price points

- Digital platforms leading to an increase in transparency and customer influence

-

- Many private and state insurance companies can offer similar health insurance policies with comparable coverage

- The presence of many competitors amid a large untapped market

- Price wars and aggressive marketing strategies

- Differentiation through digital transformation, customer service, and product innovation

- Market consolidation through mergers and acquisitions

- Barriers to the industry owing to are contractual obligations to policyholders

hear from our leadership

MR. S. R. ABEYNAYAKE,

Executive Director / Deputy Chief Executive Officer

-

Ceylinco Life’s products are designed to cater to a wide range of customer preferences and their evolving needs. The Company continues to develop new products and features to align with emerging needs. The organisation also aligns its portfolio with niche markets to ensure a competitive edge is maintained.

During the year, amid uncertainties in the market and the rising cost of healthcare, the focus was primarily on short-term policies and health-linked life insurance policies such as Medical Saver. The Company also provides solutions for those seeking long-term financial security and stability, with children’s insurance and education plans (Degree Saver/ Sipsetha), while retirement and pension plans (Pension saver/CRA) cater to the needs of an aging population.

As an organisation focused on inclusion and diversity, Ceylinco Life offers insurance solutions for largely untapped or emerging markets. For instance, micro insurance policies such as Pradeepa offer affordable, simplified insurance policies tailored to rural and underserved segments to provide basic financial protection. Similarly, with the aim of empowering women, the organisation offers Saubhagya, a women’s insurance plan designed with benefits for maternity care, women-specific health risks, and child education planning. -

The impact of Sri Lanka’s economic crisis, inflation, and currency fluctuations continued to affect policyholder affordability and investment returns. Taxation and compliance requirements, in addition to the adoption of new standards such as SLFRS 17 SLFRS 09 impacts to the industry, underscored by stringent regulatory scrutiny regarding product pricing and policyholder protection, and Risk-Based Capital (RBC) requirements. Additionally,global inflation and risk factors have led to higher reinsurance costs for local insurers.

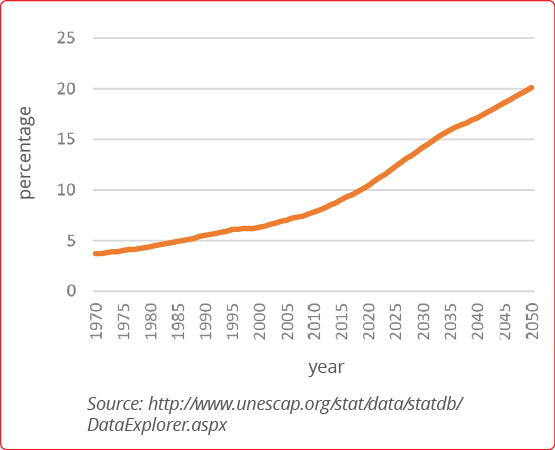

At present, life insurance penetration remains below regional averages amounting to approximately 0.6% of GDP, requiring increased awareness and accessibility. In response, Ceylinco Life conducts annual campaigns during life insurance week, and commenced outreach programmes to educate future generations on the importance of life insurance. -

The organisation relied on a range of strategies encompassing digital transformation, enhancing the customer experience, and brand building and marketing. These collective strategies ensured that customers remained at the heart of Ceylinco Life’s decision making, while driving superior value to policyholders.

Ceylinco Life engaged in sales channel expansion via a hybrid distribution model that is built on digital and physical channels, strengthened by the launch of new distribution methods such as digital sales teams.

A longstanding reputation for trust is a vital component of strategy, and the Company therefore engaged in wide-ranging CSR programmes that contribute to social causes, such as health, education, and environmental protection, to foster goodwill and strengthen brand reputation. As in the past, the Company also maintained a robust financial position, which serves to instills trust and confidence among customers. -

With a growing focus on the Gen-Z population, there are increased opportunities to build brand visibility, and strengthen brand popularity. Furthermore, with the migration of skilled workers, it is integral for insurance companies to focus on talent development and engagement.

In order to keep the pace with the changing landscape, and maintain customer loyalty, the highest standards of operational excellence, customer centricity and digital transformation will be key growth enablers in the year ahead.

economic outlook for 2025 and beyond

The outlook of Sri Lanka and its life insurance industry is shaped by several macroeconomic and sector-specific factors, outlined below:

Sri Lanka’s Economic Outlook

Following the impacts of the economic crisis in 2022, Sri Lanka is currently in a recovery phase, underpinned by targeted efforts to stabilise the economy and implement vital reforms. The country is focusing on fiscal consolidation, debt restructuring, and attracting foreign investment.

If the monetary policy holds its current trajectory and remains effective, inflation is expected to stabilise, while interest rates could exhibit a decline. The resulting climate could potentially benefit financial services, which encompasses the insurance industry.

Sri Lanka's economic future will likely be influenced by global economic conditions, including the performance of its key trading partners and global commodity prices. Trade and tourism, particularly with China, India, and the Middle East, will remain critical to the economy's recovery.

The stabilisation of the Sri Lankan rupee and the growth of foreign exchange reserves will play a significant role in Sri Lanka’s ability to attract investment and support the local financial system.

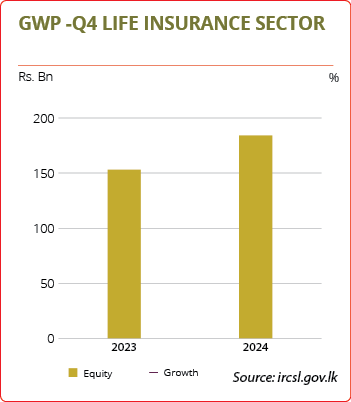

The Sri Lankan life insurance sector is growing steadily, with a projected market volume of $0.58 billion by 2029 (CAGR 1.8%).